Services

Empowering Businesses with Smarter Financial Solutions

Home / Services

STEP ONE:

REVIEW FUND XI SLIDE DECK

STEP TWO:

REVIEW THE FOLLOWING EXECUTIVE SUMMARY

EXECUTIVE SUMMARY – ECFG FUND XI: Secured Real Estate Lending for Cash Flow

Equity Capital Funding Group Fund XI

We are excited to provide a stable predictable high yield private lending debt fund, secured by real estate, with a protection of principal escrow provided by the sponsor and redemption clause features provided for liquidity. Our management team has historically had very low default rates and collected the principal anticipated returns upon completion of the foreclosure process.

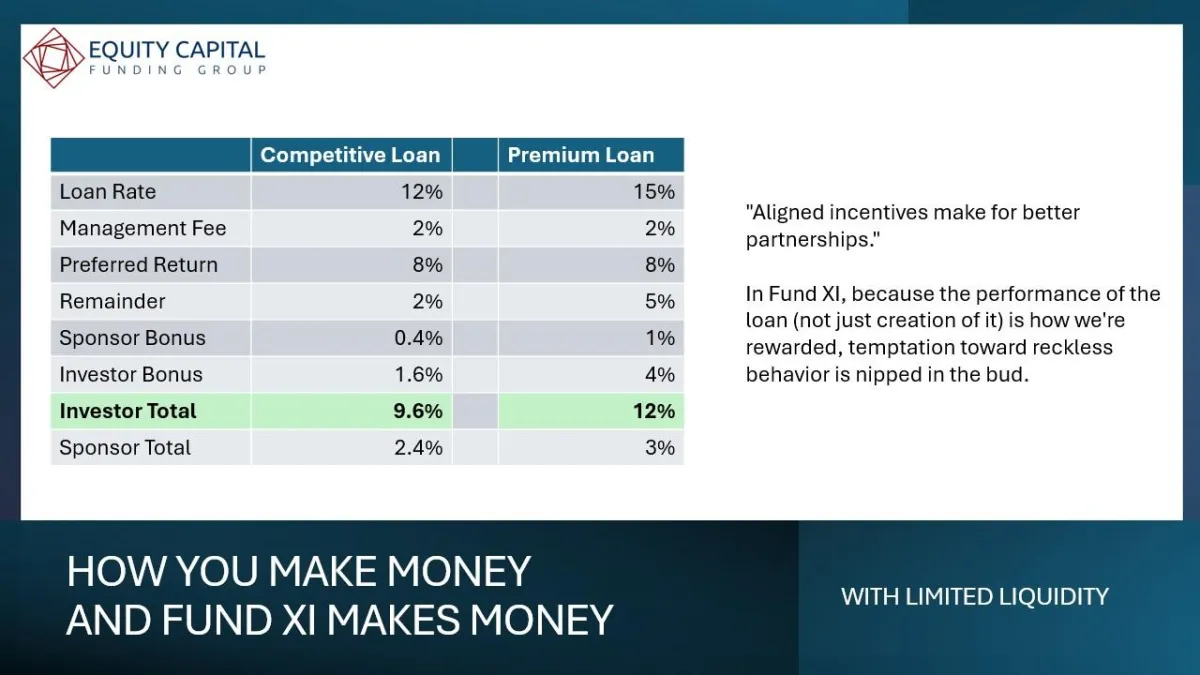

Fund XI allows investors in real estate to capture a fairly predictable 9.6-11.0% or more return on their capital with quarterly payments

The Fund is managed by principals with over 35 years’ experience in the private lending real estate sector, including thousands of transactions and hundreds of millions of dollars of loans

After a short deployment period of 90-days and an 18-month lock-up period, you can request return of your capital

Typically, these conservative loans are paid as agreed over 98% of the time, therefore providing the stable yield and security of principal

The Sponsor is depositing up to 2% of the portfolio (not to exceed $500k) to provide an additional layer of security in the portfolio

There are no subscription or acquisition fees for participation

There is a 2% annual management fee

There are no redemption fees, unless there are special circumstances regarding timing

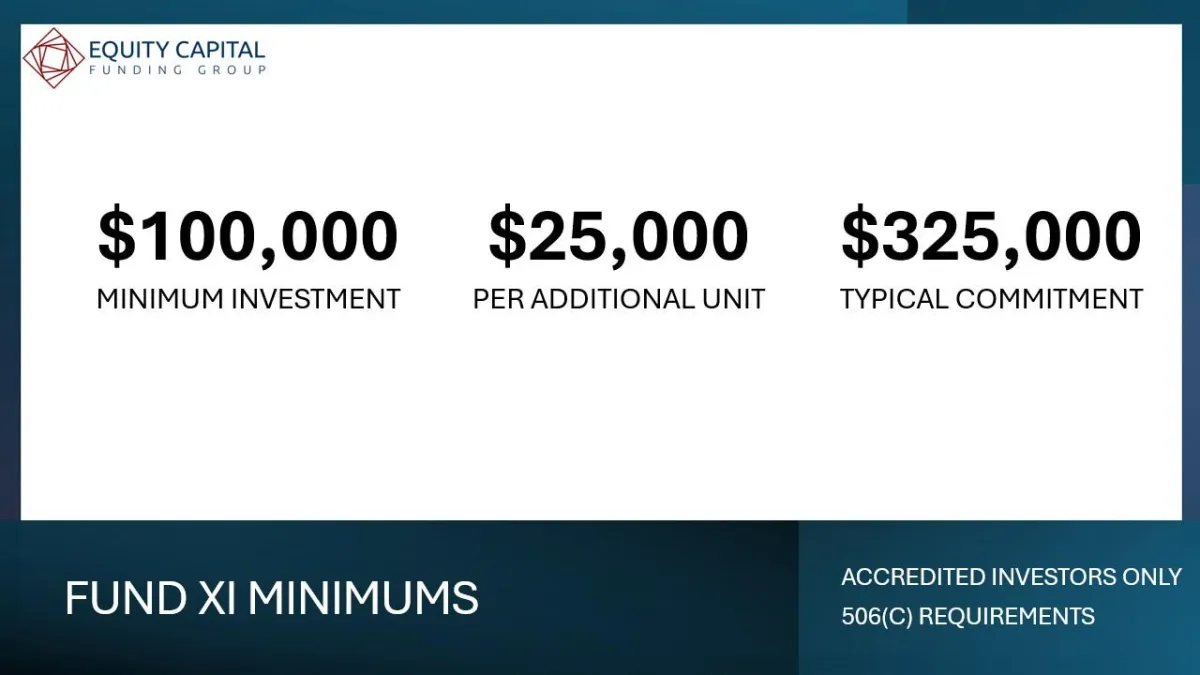

$100,000 Minimum Investment

The Market

We lend nationwide, typically to real estate professionals in both the residential and small commercial real estate space. We typically lend in states that are landlord and investor friendly, with eviction and foreclosure laws to protect the asset.

Expertise You Can Trust

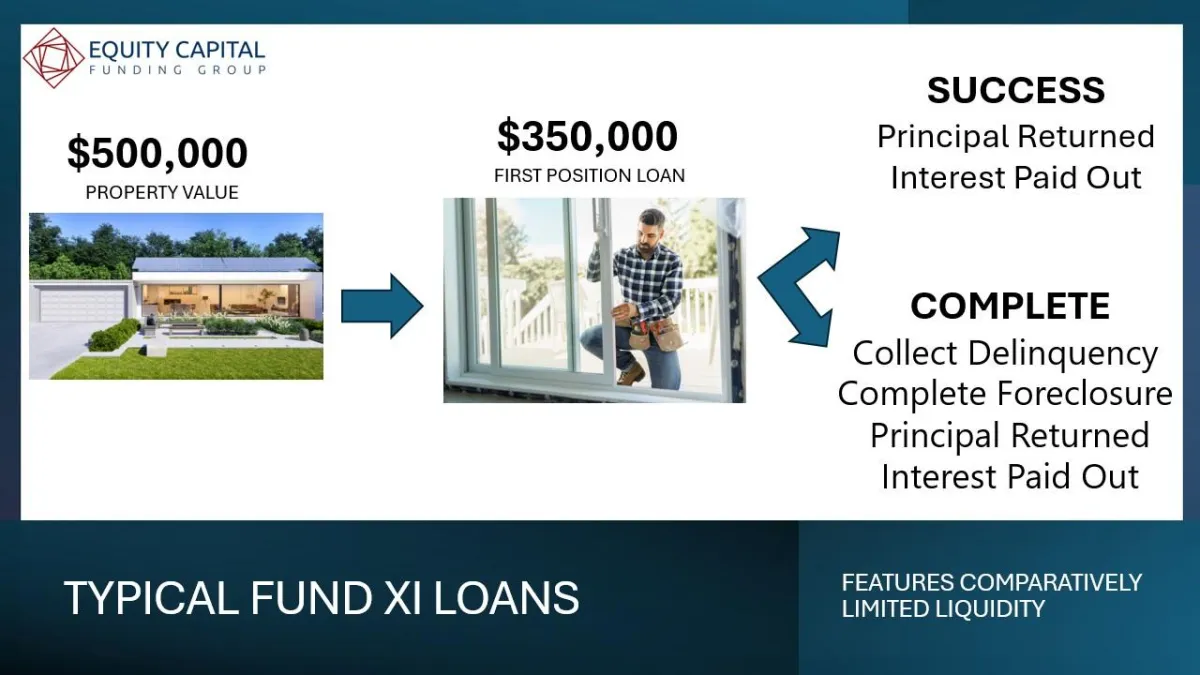

Your investment is secured by real estate at a loan to value, typically less than 70%, which usually allows for a foreclosure sale adequate enough to recoup the principal when a default occurs. The portfolio management team has experienced historical default rates of less than 3%, with actual losses of less than 1% of the portfolio value. By providing a 2% escrow, the sponsor can purchase loans that may not be paid as agreed. When paid as agreed, typically the less than $2 million loans are paid within maturity periods of 12-24 months, with interest collected monthly. Full details are in the PPM.

Investor Expectation

Investors can expect Equity Capital Fund XI to put their investment to work within the 90-day deployment period, to receive stable cash flow at an anticipated 9.6-11.0% annual rate of return and to receive a distribution of capital within 90 days of the request on a best-efforts basis, after the 18-month lock-up period.

Investors can expect us to use our skills and our capital in escrow to mitigate their risk of default and cover any loss of up to 2% of the portfolio, on a best efforts basis. We focus on building wealth by protecting clients capital with the lowest fees possible.

Alignment of Objectives

Equity Capital gets paid when the investor receives payment. Our management fee is paid as the portfolio produces its yield, after proper deployment. The investor receives an 8% preferred return and any return above that is split 80/20 between the LP and GP. This alignment of being paid when our investors are paid provides a flexible way for investors to retain purchasing power in their available real estate capital. The fiduciary passes the highest levels of background & credit scrutiny.

We welcome your inquiries and your interest in our private placement debt fund.

FINAL STEP: SOFT COMMIT OR BOOK AN APPOINTMENT

MORE ABOUT US

Our Mission

Our mission is to build and maintain a transparent partnership with our investors. We focus on strengthening the EQUITY CAPITAL FUNDING GROUP brand, attracting new investors, and nurturing existing relationships to foster long-term growth and success. By prioritizing the financial goals of our investors, we pledge to exceed their expectations and ensure their financial security and prosperity through sound investment strategies and unparalleled market expertise.

Who We Are

Equity Capital Funding Group is dedicated to empowering investors with the opportunities for sustained financial growth and security. Leveraging our extensive expertise in both residential and commercial real estate investing, we are committed to safeguarding and enhancing investor capital through strategic, informed private lending. Our 35+ years of experience in the real estate sector positions us as trusted advisors within the real estate community.

Partner With EQUITY CAPITAL Today. Stay Informed, Stay Ahead

Investing is about more than growing wealth—it’s about securing a future you can count on. At EQUITY CAPITAL FUNDING GROUP, we make investing simple, transparent, and aligned with protecting your capital.

We help real estate investors get stable predictable high yield private lending debt, secured by real estate, with a protection of principal escrow provided by the sponsor and redemption clause features provided for liquidity.

USEFUL LINKS

KEEP IN TOUCH

Fill in the form below and we will inform you of new significant events.

This does not constitute an offer to sell, or a solicitation of an offer to buy any interests in the Equity Capital Funding Group Fund XI private lending fund. Any offering of securities or solicitation in connection with the sale of securities will be made pursuant to offering documents. Investing in private real estate funds and notes secured by real estate has certain inherent risks, which could result in the loss of some or all of your principal investment. Past performance stated herein is not an indicator of future results and Equity Capital Funding Group or its affiliates can in no way guarantee or warrant your success. Consult your tax advisor or financial advisor before investing. Please see the Fund’s offering documents for full details and disclosures.