Contact Us

Start the conversation to established good relationship and business.

Home / Contact

FOCUSED WITH WORK

Let's Discuss Your Business's Financial Future

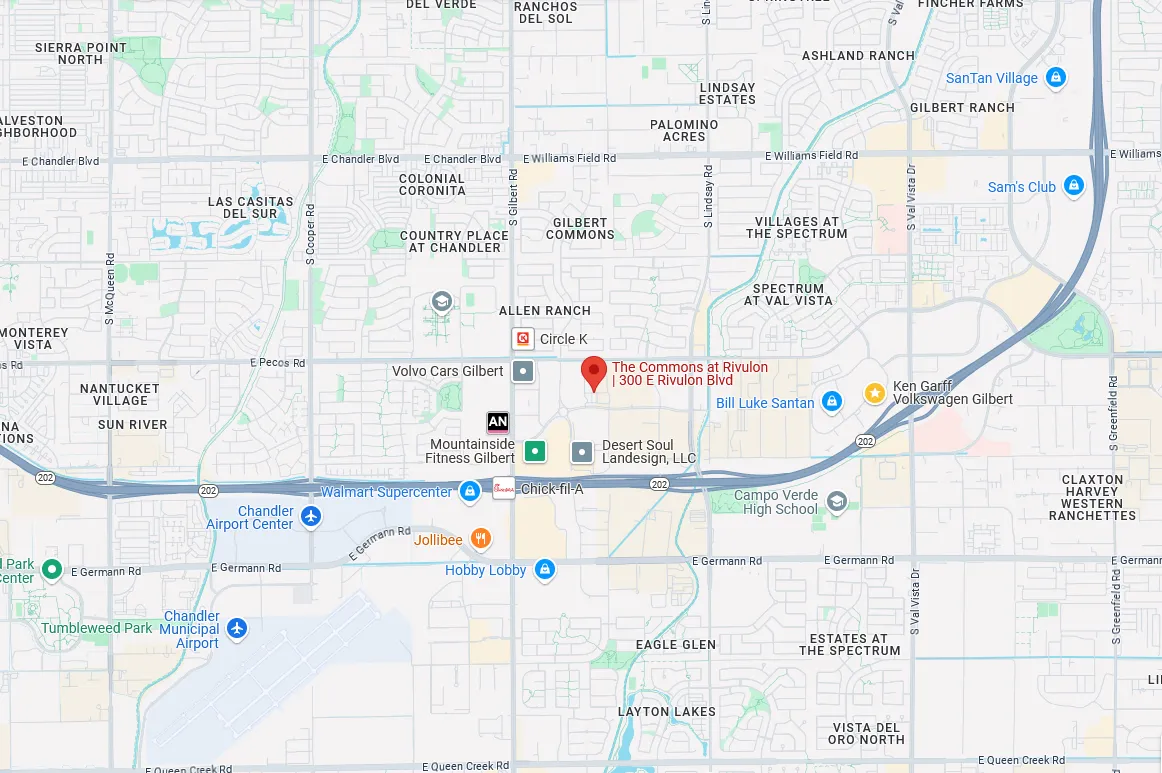

Head Office

Phoenix, Arizona Metropolitan

Email Support

Let's Talk

Office Hours

Mon - Fri

09:00 - 17:00

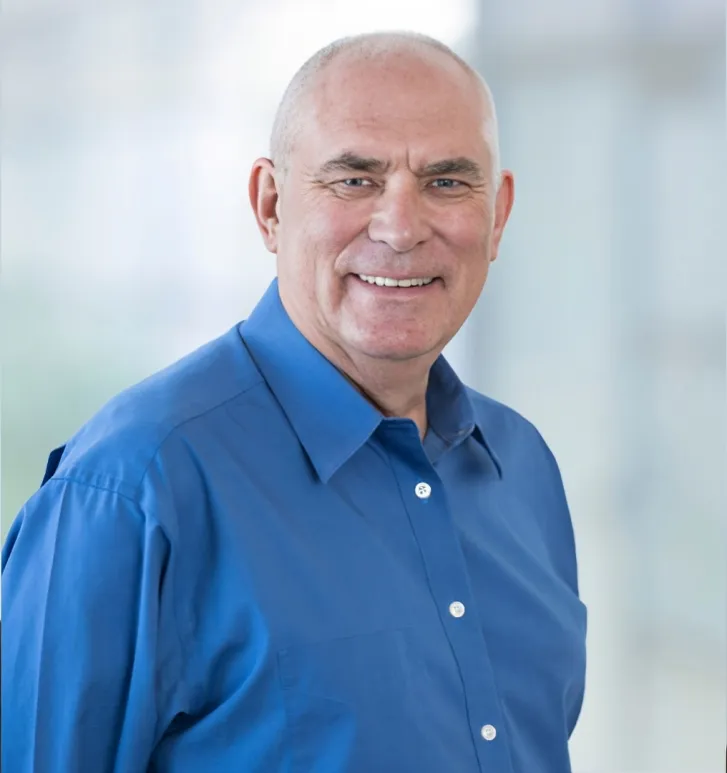

Joe Cook

CEO / Founder

Chase Murphy

Investor Relations

Send us a message

I Consent to Receive SMS Notifications, Alerts & Occasional Marketing Communication from company. Message frequency varies. Message & data rates may apply. Text HELP to (602) 900-9032 for assistance. You can reply STOP to unsubscribe at any time.

Partner With EQUITY CAPITAL Today. Stay Informed, Stay Ahead

Investing is about more than growing wealth—it’s about securing a future you can count on. At EQUITY CAPITAL FUNDING GROUP, we make investing simple, transparent, and aligned with protecting your capital.

We help real estate investors get stable predictable high yield private lending debt, secured by real estate, with a protection of principal escrow provided by the sponsor and redemption clause features provided for liquidity.

USEFUL LINKS

KEEP IN TOUCH

Fill in the form below and we will inform you of new significant events.

This does not constitute an offer to sell, or a solicitation of an offer to buy any interests in the Equity Capital Funding Group Fund XI private lending fund. Any offering of securities or solicitation in connection with the sale of securities will be made pursuant to offering documents. Investing in private real estate funds and notes secured by real estate has certain inherent risks, which could result in the loss of some or all of your principal investment. Past performance stated herein is not an indicator of future results and Equity Capital Funding Group or its affiliates can in no way guarantee or warrant your success. Consult your tax advisor or financial advisor before investing. Please see the Fund’s offering documents for full details and disclosures.